What is TCS? How to pay tcs on overseas tour package from India?

Learn what TCS on overseas tour packages is and how to pay it from India. Understand the process, rates, and steps to ensure compliance easily.

What is TCS?

Tax Collected at Source (TCS) is a mechanism in the Indian tax system where the seller collects tax from the buyer at the time of sale. This is similar to Tax Deducted at Source (TDS), but while TDS is deducted by the payer, TCS is collected by the seller. The concept of TCS is outlined under the Income Tax Act, 1961, primarily to ensure tax compliance and to widen the tax base.

TCS applies to specific categories of goods and services. The collected tax must be remitted to the government by the seller, who is also responsible for issuing a TCS certificate to the buyer. The buyer can then use this certificate to claim a credit for the TCS paid while filing their income tax return.

Table of Content

TCS on Overseas Tour Packages

View Gallery - 6

View Gallery - 6 In the context of overseas tour packages, TCS was introduced as part of the Finance Act, 2020. According to the provisions, a tax is collected by the seller at the time of the sale of an overseas tour package to an Indian buyer.

Applicability and Rate of TCS:

From October 1, 2020, TCS is applicable on the sale of overseas tour packages. The rate of TCS is set at 5% of the total amount if the aggregate value of the overseas tour package exceeds INR 7 lakh in a financial year. If the buyer does not provide their PAN or Aadhaar number, the rate increases to 10%.

For instance, if an individual purchases an overseas tour package worth INR 10 lakh, the TCS collected would be 5% of INR 10 lakh, which amounts to INR 50,000. If the individual does not provide their PAN or Aadhaar, the TCS would be 10%, totaling INR 1 lakh.

How to Pay TCS on an Overseas Tour Package

View Gallery - 6

View Gallery - 6 Paying TCS on an overseas tour package involves a few straightforward steps, whether you are an individual purchasing the package or a tour operator selling it.

Here’s a detailed guide on how to go about it:

1. Understanding the TCS Requirements

Before making any transactions, ensure that you understand the TCS requirements:

TCS is applicable at 5% if the total value of the package exceeds INR 7 lakh.

The rate increases to 10% if the buyer does not provide PAN or Aadhaar.

The tax must be collected at the time of booking the tour package.

2. Collection of PAN or Aadhaar

As a tour operator, ensure that you collect the buyer's PAN or Aadhaar number to apply the correct TCS rate. This also helps in issuing the TCS certificate accurately.

3. Calculation of TCS

Calculate the TCS amount based on the total value of the tour package. For example:

If the package costs INR 8 lakh and the buyer provides PAN, TCS is 5% of 8 lakh = INR 40,000.

If PAN is not provided, TCS is 10% of 8 lakh = INR 80,000.

4. Collecting TCS

The TCS amount must be collected from the buyer at the time of booking. This can be added to the total invoice amount. For instance, if the tour package is INR 8 lakh, the total amount payable would be INR 8 lakh + INR 40,000 (TCS) = INR 8,40,000.

5. Payment to the Government

As a tour operator, the collected TCS must be deposited with the government.

This is typically done through the following steps:

Register for TCS: Ensure that you are registered under the TCS provisions. This is usually part of your standard GST and tax registration process.Deposit TCS: The TCS collected must be deposited with the government using the specified challan (Challan No./ITNS 281) within the prescribed due dates.

File TCS Returns: File quarterly TCS returns (Form 27EQ) detailing the TCS collected and deposited. This ensures compliance and helps in issuing TCS certificates to buyers.

6. Issuing TCS Certificates

After depositing the TCS with the government, issue a TCS certificate (Form 27D) to the buyer. This certificate serves as proof of the TCS collected and can be used by the buyer to claim credit while filing their income tax returns.

Key Points to Remember

View Gallery - 6

View Gallery - 6 - TCS applies only if the aggregate value of the overseas tour package exceeds INR 7 lakh in a financial year.

- Ensure PAN or Aadhaar is collected to avoid the higher TCS rate.

- Timely deposit of TCS and filing of returns is crucial to avoid penalties.

- Buyers should retain the TCS certificate for claiming tax credit.

How to Check for TCS Deducted

You can check if TCS has been deducted by following these steps:

Form 26AS: Access your Form 26AS on the income tax department’s e-filing portal. This form reflects the TCS collected against your PAN.

TCS Certificate: Request a TCS certificate (Form 27D) from the seller. This certificate serves as proof of the TCS collected and deposited.

How to Claim TCS Refund on Foreign Travel

View Gallery - 6

View Gallery - 6 To claim a TCS refund on foreign travel, follow these steps:

Filing Income Tax Return (ITR): Include the details of the TCS paid while filing your income tax return for the relevant financial year.

Claim TCS Credit: Use the TCS certificate or Form 26AS to claim the TCS credit against your total tax liability.

Refund Process: If the TCS amount exceeds your tax liability, the excess amount will be refunded by the Income Tax Department.

Is TCS on Foreign Travel Refundable?

Yes, TCS on foreign travel is refundable. If the TCS collected exceeds your actual tax liability, you can claim a refund while filing your income tax return.

The refund will be processed by the Income Tax Department and credited to your bank account.

Step-by-Step Guide for Claiming TCS

View Gallery - 6

View Gallery - 6 - Collect Documents: Ensure you have your TCS certificate (Form 27D) or Form 26AS details.

- File Income Tax Return: Log in to the income tax e-filing portal and file your ITR.

- Enter TCS Details: In the ITR form, enter the TCS details in the appropriate section.

- Claim Credit: Claim the TCS credit against your total tax liability.

- Submit Return: Submit the ITR and verify it using the available verification methods (Aadhaar OTP, EVC, or sending a signed ITR-V to CPC).

Refund Process: The Income Tax Department will process your return, and any excess TCS will be refunded to your bank account.

Exceptions on TCS for Overseas Tour Packages from India

There are specific exceptions and conditions under which TCS may not be applicable or can be refunded.

Here are the key exceptions and scenarios:

- Government Transactions:

Transactions conducted by the Central Government, State Governments, or embassies are exempt from TCS. This exemption ensures that government operations and diplomatic missions are not burdened by this tax.

- Individuals Covered Under Section 206C(1F):

If an individual is purchasing an overseas tour package using funds from a loan sanctioned by a financial institution, and the loan is not a specified loan, TCS may not be applicable.

- Lower Rate Certificate:

If a buyer applies for and receives a lower TCS rate certificate from the Income Tax Department, the TCS can be collected at the specified lower rate instead of the standard rates of 5% or 10%.

- Payments Made Under LRS (Liberalized Remittance Scheme):

Payments made under the LRS for purposes other than purchase of an overseas tour package, such as for educational purposes, medical treatment, or maintenance of close relatives abroad, are exempt from TCS.

Debalina Deb Roy

A seasoned travel writer with a passion for exploring off beat destinations and uncovering the hidden gems. My ultimate goal is to inspire people to step out of their comfort zones and explore the world.

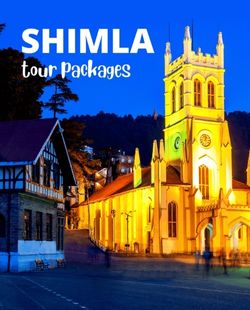

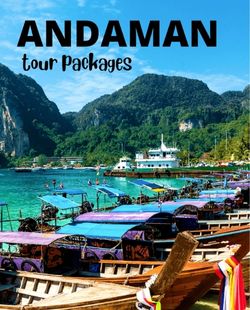

Explore best popularTour Packages

Frequenty Asked Questions

1. What is TCS on overseas tour packages?

Tax Collected at Source (TCS) on overseas tour packages is a tax mechanism where the seller collects a tax from the buyer at the time of sale. It was introduced under the Finance Act, 2020, to ensure tax compliance and track high-value transactions.

2. What is the rate of TCS on overseas tour packages?

The TCS rate is 5% if the buyer provides their PAN or Aadhaar number. If the buyer does not provide these details, the rate increases to 10%.

3. When is TCS applicable on overseas tour packages?

TCS is applicable when the total value of the overseas tour package exceeds INR 7 lakh in a financial year. However, TCS can be collected even for amounts below this threshold based on the seller's policy.

4. How is TCS calculated on overseas tour packages?

TCS is calculated as a percentage of the total amount of the tour package. For example, for a package worth INR 10 lakh, the TCS would be INR 50,000 (5%) if PAN is provided, or INR 1,00,000 (10%) if PAN is not provided.

5. How do I pay TCS on an overseas tour package?

The TCS amount is collected by the seller at the time of booking the tour package. It is included in the total invoice amount, which the buyer pays to the seller.

6. Can I claim a refund for the TCS paid on an overseas tour package?

Yes, you can claim a refund for the TCS paid while filing your income tax return if the total TCS exceeds your tax liability. The refund will be processed by the Income Tax Department.

7. How can I check if TCS has been deducted on my overseas tour package?

You can check for TCS deductions by accessing your Form 26AS on the income tax department’s e-filing portal or by requesting a TCS certificate (Form 27D) from the seller.

8. What should I do if TCS is deducted incorrectly?

If you believe TCS has been deducted incorrectly, contact the seller for clarification and correction. If the issue persists, you can address it while filing your income tax return.

9. Are there any exemptions from TCS on overseas tour packages?

Yes, transactions conducted by the Central Government, State Governments, embassies, and certain other specific scenarios are exempt from TCS. Additionally, payments made under the Liberalized Remittance Scheme (LRS) for purposes other than purchasing an overseas tour package are exempt.

10. How do I claim TCS credit while filing my income tax return?

When filing your income tax return, enter the TCS details in the appropriate section of the ITR form and use the TCS certificate or Form 26AS as proof to claim the credit against your total tax liability.

11. What happens if I don't provide my PAN or Aadhaar number?

If you do not provide your PAN or Aadhaar number, the TCS rate applicable will be 10% instead of the standard 5%.

12. Can businesses claim TCS on overseas tour packages?

Yes, businesses that book overseas tour packages and pay TCS can claim the TCS as a credit against their total tax liability while filing their income tax returns.

Tripclap connects you with top travel agents

Compare Custom Quotes and get the best package deal

1

Trusted Network Of 8000+ Agents.

2

Book everything together, including stay & transport.

3

Compare agent profiles & verified reviews.

How It Works

Compare Custom Quotes from Top Travel Agents.

Tell us about your trip

Get Custom quotes from top agents.

Choose the package you like

Latest Destinations : -

• Sanchi • Kudremukh • Mae Sot • Mashobra • Diphu • Punakha Dzong • Genting Highlands • Warsaw • Yercaud • Kozhikode • Zurich • Amarnath • Bhimtal • Madhyamaheshwar • Similan Islands • Quy Nhon • Bien Hoa • Shah Alam • Mersing • Chikmagalur • Kumily • Lavasa • Durshet • Kuala Pilah • Malappuram • Champhai • Kurseong • Halong Bay • Nellore • Rishikesh • Nahan • Netarhat • Chambaut • Santiniketan • Cao Lanh • South Male Atoll • Jowai • Haridwar • Tamenglong • Manori • Shillong • Patna • Mangalore • Khonsa • Bhimashankar • Silvassa • Phnom Penh • Ponmudi • Kanatal • Jaldhaka

• Sanchi • Kudremukh • Mae Sot • Mashobra • Diphu • Punakha Dzong • Genting Highlands • Warsaw • Yercaud • Kozhikode • Zurich • Amarnath • Bhimtal • Madhyamaheshwar • Similan Islands • Quy Nhon • Bien Hoa • Shah Alam • Mersing • Chikmagalur • Kumily • Lavasa • Durshet • Kuala Pilah • Malappuram • Champhai • Kurseong • Halong Bay • Nellore • Rishikesh • Nahan • Netarhat • Chambaut • Santiniketan • Cao Lanh • South Male Atoll • Jowai • Haridwar • Tamenglong • Manori • Shillong • Patna • Mangalore • Khonsa • Bhimashankar • Silvassa • Phnom Penh • Ponmudi • Kanatal • Jaldhaka

Best Selling Domestic Tour Packages : -

Kashmir Tour Packages Andaman Tour Packages Kerala Tour Packages Shimla Tour Packages Manali Tour Packages Sikkim Tour Packages Uttarakhand Tour Packages Rajasthan Tour Packages Chardham Tour Packages Gujarat Tour Packages Rameswaram Tour Packages Gangtok Tour Packages Goa Tour Packages Jaipur Tour Packages Ooty Tour Packages Jim Corbett Tour Packages Mussoorie Tour Packages Kanyakumari Tour Packages Meghalaya Tour Packages Ladakh Tour Packages

Kashmir Tour Packages Andaman Tour Packages Kerala Tour Packages Shimla Tour Packages Manali Tour Packages Sikkim Tour Packages Uttarakhand Tour Packages Rajasthan Tour Packages Chardham Tour Packages Gujarat Tour Packages Rameswaram Tour Packages Gangtok Tour Packages Goa Tour Packages Jaipur Tour Packages Ooty Tour Packages Jim Corbett Tour Packages Mussoorie Tour Packages Kanyakumari Tour Packages Meghalaya Tour Packages Ladakh Tour Packages

Best Selling International Tour Packages : -

Dubai Tour Packages Bali Tour Packages Singapore Tour Packages Thailand Tour Packages Maldives Tour Packages Bhutan Tour Packages Vietnam Tour Packages Mauritius Tour Packages Nepal Tour Packages Europe Tour Packages Sri lanka Tour Packages Turkey Tour Packages Malaysia Tour Packages Azerbaijan Tour Packages

Dubai Tour Packages Bali Tour Packages Singapore Tour Packages Thailand Tour Packages Maldives Tour Packages Bhutan Tour Packages Vietnam Tour Packages Mauritius Tour Packages Nepal Tour Packages Europe Tour Packages Sri lanka Tour Packages Turkey Tour Packages Malaysia Tour Packages Azerbaijan Tour Packages

Certified

We accept (more)

Members of

Media Recognition

Trusted Partners

Award

Copyrights © TripClap. All Rights Reserved

May

May June

June July

July August

August September

September October

October November

November December

December January

January February

February March

March April

April