Guard Your Journey: Countries Where Travel Insurance is a Must Before Visiting

Traveling to new and exciting destinations is a dream for many. Whether it's exploring ancient ruins, relaxing on pristine beaches, or immersing o - Tripclap

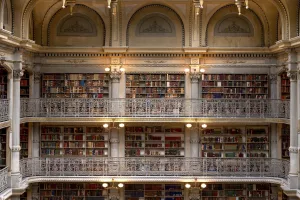

Traveling to new and exciting destinations is a dream for many. Whether it's exploring ancient ruins, relaxing on pristine beaches, or immersing oneself in a different culture, travel offers a world of experiences.

However, amidst the excitement of planning a trip, travelers often overlook a crucial aspect of their journey: travel insurance. While it may seem like an unnecessary expense, there are countries where travel insurance is a must before visiting.

Travel insurance requirements vary by country and not all countries mandate it. However, several nations, particularly those in the Schengen Area of Europe, often demand proof of travel insurance as a condition for issuing visas or allowing entry. These countries include France, Germany and Italy. Additionally, some nations in Asia, such as Thailand may require travelers to show evidence of travel insurance covering medical expenses. It's crucial to research and confirm the specific requirements of your destination, as it's not a universal requirement, but having a travel insurance is a wise choice to ensure you're adequately protected during your travels worldwide.

Countries like Cuba, Mexico and Turkey require travellers to have travel insurance in order to obtain a visa.

In this article, we will explore some of these countries where travel insurance is a must.

Table of Content

- What is a travel insurance?

- List of countries where travel insurance may be strongly advised or required:

- Antarctica - Travel Insurance

- Schengen Area - Travel Insurance

- Cuba - Travel Insurance

- Dubai - Travel Insurance

- Russia - Travel Insurance

- Thailand - Travel Insurance

- Ecuador - Travel Insurance

- China - Travel Insurance

- Cambodia - Travel Insurance

- Costa Rica - Travel Insurance

- USA - Travel Insurance

- Qatar - Travel Insurance

- Turkey - Travel Insurance

- New zealand - Travel Insurance

- Australia - Travel Insurance

- Vietnam - Travel Insurance

- Maxico - Travel Insurance

- Japan - Travel Insurance

- Canada - Travel Insurance

- Singapore - Travel Insurance

- Indonesia - Travel Insurance

- Malaysia - Travel Insurance

- Sri Lanka - Travel insurance

- Maldives - Travel Insurance

- Why are more countries making travel insurance a must?

Per Person

21,950

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

20,000

*EXCLUDING APPLICABLE TAXES 4.3 Ratings

( 218 Reviews )

( 218 Reviews )

Per Person

31,450

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

21,960

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

25,500

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

25,500

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

21,950

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

25,450

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

21,999

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 108 Reviews )

( 108 Reviews )

Per Person

13,999

*EXCLUDING APPLICABLE TAXES What is a travel insurance?

View Gallery - 28

View Gallery - 28 Travel insurance is a specialized type of insurance designed to provide financial protection and assistance to travelers when unexpected events or emergencies occur before or during their journey. It offers coverage for a range of potential risks and can vary in terms of the specific protections it provides, but generally, travel insurance includes the following key components:

Trip Cancellation or Interruption: This coverage reimburses you for prepaid, non-refundable trip expenses if you have to cancel your trip or cut it short due to covered reasons such as illness, injury, death of a family member, or certain unexpected events like natural disasters.

Medical Emergency and Evacuation: Travel insurance typically covers medical expenses if you become ill or injured while traveling. It may also include coverage for emergency medical evacuation, which is essential in remote areas or countries with limited medical facilities.

Lost or Delayed Baggage: If your luggage is lost, stolen, or delayed by the airline or transportation provider, travel insurance can provide reimbursement for necessary items, like clothing and toiletries, until your baggage is returned.

Travel Delay: This coverage reimburses you for additional expenses incurred due to unexpected travel delays, such as meals and accommodations if your flight is delayed or canceled.

Emergency Assistance: Travel insurance often includes a 24/7 assistance hotline that can help you navigate unexpected situations, including medical emergencies, lost passports, or legal assistance.

Personal Liability: This component of travel insurance can provide coverage in case you accidentally cause injury to someone else or damage their property while traveling.

Adventure and Sports Coverage: Some travel insurance policies offer coverage for adventurous activities, such as hiking, scuba diving, or skiing, which may not be covered by standard policies.

Pre-existing Conditions: Some policies provide coverage for pre-existing medical conditions if certain conditions are met, such as purchasing the insurance within a specific timeframe after booking your trip.

Cancel for Any Reason (CFAR): This is an optional add-on that allows travelers to cancel their trip for any reason not covered by standard trip cancellation policies. CFAR typically offers a partial reimbursement of prepaid trip expenses.

COVID-19 Coverage: In response to the pandemic, many travel insurance policies now offer coverage related to COVID-19, including medical expenses and trip cancellations due to the virus.

It's essential to carefully review the terms and conditions of a travel insurance policy to understand what is covered and any exclusions or limitations. Travel insurance can provide peace of mind, especially when traveling to countries with expensive healthcare systems, engaging in adventurous activities, or during uncertain times like the COVID-19 pandemic.

Travelers should choose a policy that aligns with their specific needs and destination, ensuring they have the appropriate coverage for their trip.

Places to visit in Italy

Total

6,74,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 20 Reviews )

( 20 Reviews )

Total

6,30,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 20 Reviews )

( 20 Reviews )

Total

6,06,500

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 20 Reviews )

( 20 Reviews )

Total

10,34,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 20 Reviews )

( 20 Reviews )

Total

3,30,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 20 Reviews )

( 20 Reviews )

Total

5,21,500

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 20 Reviews )

( 20 Reviews )

Per Person

29,582

*EXCLUDING APPLICABLE TAXES Per Person

25,390

*EXCLUDING APPLICABLE TAXES Total

4,96,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 20 Reviews )

( 20 Reviews )

Per Person

30,780

*EXCLUDING APPLICABLE TAXES List of countries where travel insurance may be strongly advised or required:

View Gallery - 28

View Gallery - 28 Here is a list of countries where travel insurance is a must or may be strongly advised or required:

While travel insurance is not mandatory in every country, several nations either strongly recommend or require travelers to have travel insurance coverage. These requirements or recommendations can change over time, so it's essential to check the latest information and consult with the relevant authorities or embassies before your trip.

Here is a list of countries where travel insurance is must or may be strongly advised or required:

Antarctica:

Reason: Travel insurance with comprehensive coverage is often mandatory for tourists visiting Antarctica due to the extreme and remote nature of the destination.

Schengen Area Countries (The Schengen Area encompasses 26 European countries):

Austria

Belgium

Czech Republic

Denmark

Estonia

Finland

France

Germany

Greece

Hungary

Iceland

Italy

Latvia

Lithuania

Luxembourg

Malta

Netherlands

Norway

Poland

Portugal

Slovakia

Slovenia

Spain

Sweden

Switzerland

Liechtenstein

Reason: Many Schengen countries require visitors to have travel insurance with a minimum coverage of €30,000 for medical emergencies and repatriation to obtain a Schengen visa.

Cuba:

Reason: Cuba requires all visitors to have valid travel insurance coverage that includes medical expenses.

Dubai, UAE:

Reason: Dubai's government requires visitors to have health insurance coverage to obtain a tourist visa.

Russia:

Reason: Russia requires visitors to have travel insurance coverage that includes medical emergencies and repatriation.

Thailand:

Reason: While not mandatory, travel insurance is strongly encouraged in Thailand, especially to cover medical expenses, accidents, and unforeseen events.

Ecuador:

Reason: Ecuadorian law mandates that travelers have health insurance coverage during their stay.

China:

Reason: Travel insurance is often required to obtain a visa for China, and it provides coverage for medical emergencies and unexpected events.

Cambodia:

Reason: Cambodia requires travelers to have travel insurance that covers medical expenses, including COVID-19-related costs.

Costa Rica:

Reason: Proof of travel insurance, including coverage for medical expenses and potential quarantine costs, is required for entry.

Please note that travel insurance requirements and recommendations may vary depending on factors such as your nationality, the purpose of your visit, and the specific region within a country you plan to explore. Always verify the latest travel advisories and insurance requirements for your destination to ensure compliance and appropriate coverage.

Places to visit in Thailand

Bangkok

Pattaya

Phuket

Phi Phi Islands

Krabi

Chiang Mai

Ayutthaya

Koh Samui

Chiang Rai

Sukhothai

Koh Lipe

Trang

Similan Islands

Koh Phangan

Koh Lanta

Railay

Ang Thong National Marine Park

Surat Thani

Koh Tao

Hua Hin

Nong Khai

Koh Kood

Khao Laem National Park

Koh Chang

Kanchanaburi

Ubon Ratchathani

Surin

Pai

Khao Lak

Phetchaburi

Sangkhlaburi

Chanthaburi

Koh Samet

Krabi Town

Lopburi

Nakhon Ratchasima

Mae Sot

Koh Si Chang

Koh Nang Yuan

Koh Yao Noi

Ko Jum

Hang Dong

Koh Kret

Koh Phra Thong

Koh Rok

Koh Poda

Mae Hong Son

Ao Nang

Samut Prakan

Lampang

Per Person

49,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

1,85,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 57 Reviews )

( 57 Reviews )

Per Person

26,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 109 Reviews )

( 109 Reviews )

Per Person

13,200

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 4 Reviews )

( 4 Reviews )

Per Person

49,499

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

26,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 109 Reviews )

( 109 Reviews )

Per Person

20,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

44,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

49,499

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Total

49,999

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 4 Reviews )

( 4 Reviews )

Antarctica - Travel Insurance

View Gallery - 28

View Gallery - 28 When embarking on a journey to Antarctica, comprehensive travel insurance is not just recommended; it is a country where travel insurance is must. As one of the most remote and inhospitable places on Earth, unforeseen challenges can arise.

A robust policy should encompass medical emergencies, evacuation coverage, trip cancellations, and gear protection for the extreme conditions. Given the high cost of Antarctic expeditions, it's vital to ensure that your coverage is adequate. Always carry proof of your insurance policy and understand the procedures for emergency situations. This way, you can explore the pristine landscapes of Antarctica with confidence, knowing you're well-prepared for any contingencies.

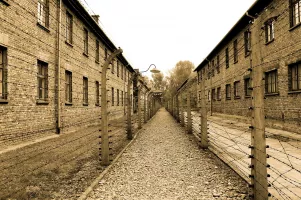

Schengen Area - Travel Insurance

View Gallery - 28

View Gallery - 28 Traveling to Schengen Area countries in Europe requires careful planning, including obtaining the necessary travel insurance. Schengen visa applicants must provide proof of travel insurance that meets certain criteria. Your policy should cover at least €30,000 in medical expenses, including emergency medical treatment and repatriation, ensuring you're financially protected in case of illness or accidents during your stay. Thus in all the countries in Schengen are travel insurance is a must.

Schengen travel insurance should be valid for the entire duration of your intended visit and for all Schengen countries you plan to visit. Check that your chosen insurer is authorized to provide coverage in the Schengen Area. You will receive an insurance certificate, which you'll need to submit when applying for a Schengen visa.

While not mandatory, it's wise to opt for comprehensive coverage, including trip cancellations, baggage loss, and personal liability, for added security.

Having suitable travel insurance ensures you meet visa requirements and safeguards your trip to these beautiful European destinations.

Places to visit in Italy

Per Person

1,85,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 57 Reviews )

( 57 Reviews )

Per Person

1,03,730

*EXCLUDING APPLICABLE TAXES Per Person

92,550

*EXCLUDING APPLICABLE TAXES Total

60,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 4 Reviews )

( 4 Reviews )

Per Person

1,22,120

*EXCLUDING APPLICABLE TAXES Total

1,26,100

*EXCLUDING APPLICABLE TAXES Per Person

1,18,820

*EXCLUDING APPLICABLE TAXES Per Person

1,41,120

*EXCLUDING APPLICABLE TAXES Total

6,74,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 20 Reviews )

( 20 Reviews )

Per Person

1,22,700

*EXCLUDING APPLICABLE TAXES Cuba - Travel Insurance

View Gallery - 28

View Gallery - 28 When traveling to Cuba, having travel insurance is a must. Cuba requires all visitors to have travel insurance that covers medical expenses during their stay. This insurance is mandatory and must be purchased before entering the country. It should cover at least $10,000 in medical expenses to ensure that you are financially protected in case of unexpected illnesses or accidents while in Cuba.

Additionally, your insurance policy should be from an approved Cuban insurance provider or a recognized international insurer. Always carry proof of your insurance coverage, as Cuban authorities may ask for it upon arrival. While the country offers excellent healthcare services, having travel insurance provides peace of mind and ensures you receive timely and adequate medical attention if needed, making your trip to Cuba a safer and more enjoyable experience.

Dubai - Travel Insurance

View Gallery - 28

View Gallery - 28 When planning a trip to Dubai, UAE, it's advisable to have comprehensive travel insurance. While it's not a mandatory requirement for entry, having insurance provides you with essential financial protection and peace of mind during your visit. A good travel insurance policy for Dubai should cover various aspects, including medical emergencies, trip cancellations or interruptions, lost luggage, and personal liability.

Medical coverage is particularly important as healthcare in Dubai can be expensive for visitors. Ensure your policy includes coverage for at least $50,000 to $100,000 for medical expenses. Additionally, your insurance should cover any unexpected disruptions to your travel plans, such as flight cancellations or delays.

Dubai is known for its luxurious lifestyle, and while it is generally safe, unforeseen incidents can happen anywhere. Having travel insurance ensures that you are well-prepared to handle any unexpected situations that may arise during your visit to this vibrant and dynamic city. Always carry proof of your insurance policy, and know how to contact your insurer in case of emergencies.

Places to visit in Dubai

Total

3,57,500

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 21 Reviews )

( 21 Reviews )

Per Person

41,000

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 109 Reviews )

( 109 Reviews )

Per Person

49,999

*EXCLUDING APPLICABLE TAXES 4.6 Ratings

( 22 Reviews )

( 22 Reviews )

Per Person

22,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 4 Reviews )

( 4 Reviews )

Per Person

18,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 4 Reviews )

( 4 Reviews )

Per Person

52,500

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 109 Reviews )

( 109 Reviews )

Per Person

74,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Total

2,92,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 20 Reviews )

( 20 Reviews )

Per Person

26,900

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 255 Reviews )

( 255 Reviews )

Per Person

21,000

*EXCLUDING APPLICABLE TAXES 4.3 Ratings

( 218 Reviews )

( 218 Reviews )

Russia - Travel Insurance

View Gallery - 28

View Gallery - 28 When traveling to Russia, having comprehensive travel insurance is highly advisable. While it is not a mandatory requirement for obtaining a Russian visa, it offers crucial financial protection and peace of mind during your trip.

A suitable travel insurance policy for Russia should cover various aspects, including medical emergencies, trip cancellations or interruptions, lost luggage, and personal liability.

Medical coverage is particularly important, as healthcare in Russia can be costly for foreign visitors. Ensure that your policy provides coverage for at least $50,000 to $100,000 for medical expenses. It's also wise to opt for coverage that includes repatriation in case of a severe medical emergency.

Travel insurance ensures that you are well-prepared to handle unexpected situations while exploring the vast and diverse landscapes of Russia. Always carry proof of your insurance policy, and know how to contact your insurer in case of emergencies to make your journey in Russia a safer and more enjoyable experience.

Places to visit in Russia

Per Person

69,990

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

69,990

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

21,590

*EXCLUDING APPLICABLE TAXES Per Person

1,32,499

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 9 Reviews )

( 9 Reviews )

Per Person

27,200

*EXCLUDING APPLICABLE TAXES Per Person

22,940

*EXCLUDING APPLICABLE TAXES Per Person

24,950

*EXCLUDING APPLICABLE TAXES Per Person

44,006

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 200 Reviews )

( 200 Reviews )

Per Person

69,980

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

76,000

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 200 Reviews )

( 200 Reviews )

Thailand - Travel Insurance

View Gallery - 28

View Gallery - 28 When traveling to Thailand, having comprehensive travel insurance is highly recommended. While it is not must to have a travel insurance in Thailand. Having a travel insurance, provides essential financial protection and peace of mind during your trip. A suitable travel insurance policy for Thailand should cover various aspects, including medical emergencies, trip cancellations or interruptions, lost luggage, and personal liability.

Medical coverage is particularly important, as healthcare expenses can add up in case of illness or injury. Ensure your policy includes coverage for at least $50,000 to $100,000 for medical expenses. Additionally, consider coverage for activities such as adventure sports or motorbike rentals, which may have additional risks.

Thailand offers diverse experiences, from bustling cities to serene beaches, and insurance ensures you're well-prepared for unexpected situations. Always carry proof of your insurance policy, and be aware of how to contact your insurer in case of emergencies. This way, you can fully enjoy your journey in Thailand while staying protected.

Places to visit in Thailand

Bangkok

Pattaya

Phuket

Phi Phi Islands

Krabi

Chiang Mai

Ayutthaya

Koh Samui

Chiang Rai

Sukhothai

Koh Lipe

Trang

Similan Islands

Koh Phangan

Koh Lanta

Railay

Ang Thong National Marine Park

Surat Thani

Koh Tao

Hua Hin

Nong Khai

Koh Kood

Khao Laem National Park

Koh Chang

Kanchanaburi

Ubon Ratchathani

Surin

Pai

Khao Lak

Phetchaburi

Sangkhlaburi

Chanthaburi

Koh Samet

Krabi Town

Lopburi

Nakhon Ratchasima

Mae Sot

Koh Si Chang

Koh Nang Yuan

Koh Yao Noi

Ko Jum

Hang Dong

Koh Kret

Koh Phra Thong

Koh Rok

Koh Poda

Mae Hong Son

Ao Nang

Samut Prakan

Lampang

Per Person

49,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

26,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 109 Reviews )

( 109 Reviews )

Per Person

13,200

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 4 Reviews )

( 4 Reviews )

Per Person

49,499

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

26,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 109 Reviews )

( 109 Reviews )

Per Person

20,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

44,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

49,499

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Total

49,999

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 4 Reviews )

( 4 Reviews )

Per Person

30,000

*EXCLUDING APPLICABLE TAXES 4.3 Ratings

( 218 Reviews )

( 218 Reviews )

Ecuador - Travel Insurance

View Gallery - 28

View Gallery - 28 Traveling to Ecuador requires travel insurance for a safe and worry-free trip. While not officially mandated for entry, it's highly recommended. A robust policy should cover medical emergencies, trip cancellations, lost baggage, and personal liability. Ensure your medical coverage amounts to at least $50,000 to handle potential healthcare costs.

As Ecuador offers diverse experiences, including the Amazon rainforest and the Galápagos Islands, comprehensive insurance safeguards you in various scenarios. Always carry proof of your policy and know how to contact your insurer during emergencies. This ensures you can fully enjoy your Ecuadorian adventure while having essential protection.

Per Person

1,054

*EXCLUDING APPLICABLE TAXES China - Travel Insurance

View Gallery - 28

View Gallery - 28 When traveling to China, securing travel insurance is highly recommended. While not obligatory for entry, it provides essential financial protection during your visit. A comprehensive policy should cover medical emergencies, trip cancellations, lost luggage, and personal liability. Ensure your medical coverage is at least $50,000 to address potential healthcare expenses.

China offers diverse experiences, from ancient historical sites to modern cities, and insurance ensures you're prepared for unexpected situations. Always carry proof of your insurance policy and know how to contact your insurer in emergencies. This way, you can explore China with peace of mind, knowing you have the necessary protection.

Places to visit in China

Per Person

3,00,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 57 Reviews )

( 57 Reviews )

Cambodia - Travel Insurance

View Gallery - 28

View Gallery - 28 When visiting Cambodia, having travel insurance is strongly recommended. Though not a mandatory requirement for entry, it offers vital financial protection and peace of mind. A robust policy should cover medical emergencies, trip cancellations, lost luggage, and personal liability. Ensure that your medical coverage is sufficient, typically around $50,000, to address potential healthcare costs.

Cambodia's rich cultural heritage and natural beauty attract travelers, and insurance ensures you're prepared for unforeseen circumstances. Always carry proof of your insurance policy, and know how to contact your insurer in case of emergencies. This way, you can explore Cambodia safely and enjoy your journey with confidence.

Places to visit in Cambodia

Per Person

41,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

64,500

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 200 Reviews )

( 200 Reviews )

Per Person

49,865

*EXCLUDING APPLICABLE TAXES Per Person

1,21,588

*EXCLUDING APPLICABLE TAXES Per Person

61,900

*EXCLUDING APPLICABLE TAXES Per Person

62,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

56,999

*EXCLUDING APPLICABLE TAXES Per Person

98,987

*EXCLUDING APPLICABLE TAXES Costa Rica - Travel Insurance

View Gallery - 28

View Gallery - 28 Travel insurance is highly recommended when visiting Costa Rica. While not a strict requirement for entry, it provides crucial financial protection. A comprehensive policy should cover medical emergencies, trip cancellations, lost luggage, and personal liability. Ensure your medical coverage is sufficient, typically around $50,000, to address potential healthcare expenses.

Costa Rica's diverse natural beauty, including rainforests and beaches, invites travelers, and insurance ensures you're prepared for unexpected situations. Always carry proof of your insurance policy and know how to contact your insurer in emergencies. This way, you can explore Costa Rica with peace of mind, knowing you have essential protection.

Per Person

23,979

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 200 Reviews )

( 200 Reviews )

USA - Travel Insurance

View Gallery - 28

View Gallery - 28 Travel insurance for the USA is highly advisable for international visitors. While not a mandatory entry requirement, it provides essential financial protection. A comprehensive policy should cover medical emergencies, trip cancellations, lost baggage, and personal liability.

Medical coverage should ideally be around $100,000, as healthcare costs can be high in the United States. The USA offers diverse attractions, from vibrant cities to natural wonders, and insurance ensures you're prepared for unexpected situations. Always carry proof of your insurance policy and know how to contact your insurer in emergencies. This way, you can explore the USA with peace of mind, knowing you have essential protection.

Per Person

86,500

*EXCLUDING APPLICABLE TAXES Per Person

78,500

*EXCLUDING APPLICABLE TAXES Per Person

1,10,500

*EXCLUDING APPLICABLE TAXES Per Person

8,500

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 157 Reviews )

( 157 Reviews )

Per Person

1,01,200

*EXCLUDING APPLICABLE TAXES Per Person

90,500

*EXCLUDING APPLICABLE TAXES Per Person

13,500

*EXCLUDING APPLICABLE TAXES 4.3 Ratings

( 389 Reviews )

( 389 Reviews )

Per Person

98,500

*EXCLUDING APPLICABLE TAXES Per Person

1,02,500

*EXCLUDING APPLICABLE TAXES Per Person

96,500

*EXCLUDING APPLICABLE TAXES Qatar - Travel Insurance

View Gallery - 28

View Gallery - 28 While not mandatory for all travelers, obtaining travel insurance is highly advisable when visiting Qatar. This small but affluent Gulf nation is known for its luxurious amenities and cultural attractions, making it a popular destination.

A comprehensive insurance policy should include coverage for medical emergencies, as well as trip cancellations, lost luggage, and unexpected delays. Qatar's hot desert climate and diverse activities, like desert safaris or water sports, can pose risks, making insurance a valuable safety net. Though not an absolute requirement, a well-tailored policy ensures a worry-free and protected experience while exploring the charms of Qatar.

Turkey - Travel Insurance

View Gallery - 28

View Gallery - 28 When planning a visit to Turkey, it's important to consider both travel insurance and visa requirements. While travel insurance is not a mandatory condition for obtaining a Turkish tourist visa, it's highly recommended. A comprehensive policy should cover medical emergencies, trip cancellations, lost luggage and unexpected delays, ensuring a safe and stress-free trip.

Turkey typically requires tourists to obtain an e-Visa, which can be applied for online before arrival. Having travel insurance in place is especially valuable given the country's rich historical sites and diverse activities. Both insurance and a valid visa are essential elements for a smooth and enjoyable journey through Turkey's captivating landscapes and cultural heritage.

Places to visit in Turkey

Per Person

1,52,871

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 109 Reviews )

( 109 Reviews )

Per Person

32,460

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

32,475

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

23,520

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

60,950

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Total

4,04,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 20 Reviews )

( 20 Reviews )

Per Person

40,500

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 255 Reviews )

( 255 Reviews )

Per Person

59,890

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

1,93,750

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 20 Reviews )

( 20 Reviews )

Per Person

60,900

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

New zealand - Travel Insurance

View Gallery - 28

View Gallery - 28 Travel insurance is essential when visiting New Zealand but it is not a must to visit this country. This stunning destination offers diverse outdoor activities, including hiking, water sports, and more. A comprehensive insurance policy should cover medical emergencies, trip cancellations, lost baggage, and unexpected delays. New Zealand's remote locations and adventurous pursuits can entail risks, making insurance a vital safety net.

While it's not a strict entry requirement, having the right coverage ensures you're protected throughout your journey, allowing you to explore the breathtaking landscapes and Maori culture with peace of mind.

Places to visit in New Zealand

Total

7,44,672

*EXCLUDING APPLICABLE TAXES Per Person

1,100

*EXCLUDING APPLICABLE TAXES Per Person

42,518

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 200 Reviews )

( 200 Reviews )

Per Person

65,000

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 200 Reviews )

( 200 Reviews )

Total

6,23,700

*EXCLUDING APPLICABLE TAXES Per Person

8,500

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 157 Reviews )

( 157 Reviews )

Per Person

13,500

*EXCLUDING APPLICABLE TAXES 4.3 Ratings

( 389 Reviews )

( 389 Reviews )

Per Person

16,999

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 157 Reviews )

( 157 Reviews )

Per Person

86,500

*EXCLUDING APPLICABLE TAXES Per Person

78,500

*EXCLUDING APPLICABLE TAXES Australia - Travel Insurance

View Gallery - 28

View Gallery - 28 Travel insurance is strongly recommended when visiting Australia. It's a vast and diverse country with many exciting outdoor activities, like diving the Great Barrier Reef or exploring the Outback. A comprehensive insurance policy should cover medical emergencies, trip cancellations, lost luggage, and unexpected delays. While not a mandatory entry requirement, it's a smart choice for safeguarding your trip.

Australia's remote regions and potential risks make insurance a valuable safety net, ensuring a worry-free exploration of this beautiful land of unique wildlife, stunning landscapes, and vibrant cities.

Places to visit in Australia

Per Person

1,64,500

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 109 Reviews )

( 109 Reviews )

Per Person

93,990

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

93,990

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

93,980

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

2,19,900

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 15 Reviews )

( 15 Reviews )

Per Person

975

*EXCLUDING APPLICABLE TAXES Per Person

64,770

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 58 Reviews )

( 58 Reviews )

Per Person

1,12,378

*EXCLUDING APPLICABLE TAXES Per Person

38,115

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 255 Reviews )

( 255 Reviews )

Per Person

1,02,850

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 255 Reviews )

( 255 Reviews )

Vietnam - Travel Insurance

View Gallery - 28

View Gallery - 28 While travel insurance isn't a strict requirement for entering Vietnam, it's highly advisable. Vietnam's diverse landscapes, bustling cities, and local cuisine offer incredible experiences, but travel can be unpredictable. Having the right insurance ensures you're prepared for any unforeseen circumstances, enhancing your peace of mind during your visit. It's a sensible choice to safeguard your trip and enjoy this culturally rich and scenic Southeast Asian destination.

Places to visit in Vietnam

Halong Bay

Ho Chi Minh City

Hoi An

Hanoi

Phong Nha

Da Nang

Sapa

Nha Trang

Ba Be National Park

Hue

Dalat

Mekong Delta

Mui Ne

Bai Tu Long Bay

Ninh Binh

Phu Quoc Island

Bach Ma National Park

Con Dao Islands

Dong Hoi

Dien Bien Phu

Son La

Cat Tien National Park

Bac Ha

Phan Thiet

Lai Chau

Hoa Binh

Lao Cai

Haiphong

Ca Mau

Mong Cai

Vinh Long

Tuy Hoa

Mai Chau

Sa Dec

Vung Tau

Quy Nhon

Bien Hoa

Cao Lanh

Pleiku

Tay Ninh

Kon Tum

Buon Ma Thuot

Long Xuyen

My Tho

Ben Tre

Hai Van Pass

Nui Sam

Per Person

38,920

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

92,000

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 109 Reviews )

( 109 Reviews )

Per Person

58,849

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

56,499

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

30,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 109 Reviews )

( 109 Reviews )

Per Person

32,999

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 4 Reviews )

( 4 Reviews )

Per Person

41,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

18,430

*EXCLUDING APPLICABLE TAXES Per Person

48,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 4 Reviews )

( 4 Reviews )

Per Person

1,00,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 57 Reviews )

( 57 Reviews )

Maxico - Travel Insurance

View Gallery - 28

View Gallery - 28 Another country where travel insurance is a must is Mexico, as it offers crucial protection for a safe and enjoyable trip. For a trip to Mexico, ensure your travel insurance meets specific criteria. Look for coverage that includes medical expenses, encompassing COVID-19-related healthcare. Verify coverage for trip cancellations, lost luggage, and unexpected delays. If you plan to enjoy outdoor activities or adventure sports, make sure these are included.

The policy should match your travel duration and offer 24/7 emergency assistance.

Check for any country-specific requirements. Prioritize comprehensive coverage to provide peace of mind during your Mexican journey, as unexpected situations can arise, and having the right insurance ensures you're prepared.

Japan - Travel Insurance

View Gallery - 28

View Gallery - 28 While not mandatory, securing travel insurance before your trip to Japan is highly recommended. Japan's unique culture, beautiful landscapes, and bustling cities make it a popular destination. Travel insurance offers essential coverage for medical emergencies, trip interruptions, lost belongings, and unforeseen delays. The country's mix of ancient traditions and modern experiences is enchanting, but unforeseen situations can occur.

Having the right insurance provides peace of mind, ensuring you're well-prepared for any unexpected events and allowing you to fully enjoy your visit to this captivating East Asian nation.

Places to visit in Japan

Per Person

2,98,999

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

2,50,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 57 Reviews )

( 57 Reviews )

Per Person

1,95,000

*EXCLUDING APPLICABLE TAXES 3.8 Ratings

( 8 Reviews )

( 8 Reviews )

Per Person

2,54,000

*EXCLUDING APPLICABLE TAXES 3.8 Ratings

( 8 Reviews )

( 8 Reviews )

Per Person

81,521

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 200 Reviews )

( 200 Reviews )

Per Person

96,654

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 200 Reviews )

( 200 Reviews )

Per Person

2,50,000

*EXCLUDING APPLICABLE TAXES 3.8 Ratings

( 8 Reviews )

( 8 Reviews )

Per Person

54,347

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 200 Reviews )

( 200 Reviews )

Per Person

2,00,000

*EXCLUDING APPLICABLE TAXES 3.8 Ratings

( 8 Reviews )

( 8 Reviews )

Per Person

71,630

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 200 Reviews )

( 200 Reviews )

Canada - Travel Insurance

View Gallery - 28

View Gallery - 28 For a trip to Canada, certain travel insurance criteria are essential. Your policy should include coverage for medical expenses, encompassing potential COVID-19-related healthcare. Ensure it offers protection for trip cancellations, lost luggage, and unexpected travel disruptions.

If you plan to partake in outdoor activities such as skiing or hiking, confirm that they are covered. Match the policy duration to your travel plans and check if it provides 24/7 emergency assistance. Additionally, consider any country-specific requirements set by Canadian authorities. Comprehensive insurance guarantees a secure and worry-free visit to the diverse landscapes of Canada.

Per Person

47,098

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 200 Reviews )

( 200 Reviews )

Per Person

67,529

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 200 Reviews )

( 200 Reviews )

Per Person

2,34,786

*EXCLUDING APPLICABLE TAXES Per Person

1,51,363

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 200 Reviews )

( 200 Reviews )

Singapore - Travel Insurance

View Gallery - 28

View Gallery - 28 To visit Singapore, a suitable travel insurance policy should include several key elements. First, ensure it offers comprehensive medical coverage, encompassing COVID-19-related healthcare expenses. Next, verify that it covers trip cancellations, lost baggage, and potential delays.

Singapore's diverse attractions may involve some adventure, so confirm that outdoor activities are included. Match the policy duration to your travel plans and check if it provides 24/7 emergency assistance. While not mandatory, consider any specific requirements set by Singaporean authorities to guarantee a worry-free visit to this dynamic city-state.

Places to visit in Singapore

Gardens by the Bay

Singapore Botanic Gardens

Singapore Zoo

National Orchid Garden

SEA Aquarium

Sands SkyPark Observation Deck

Universal Studios Singapore

Sentosa Island

Marina Bay Sands

Singapore Night Safari

Merlion Park

Pulau Ubin

Cloud Forest

Singapore Flyer

Jurong Bird Park

Singapore Cable Car

National Gallery Singapore

National Museum of Singapore

OCBC Skyway

Haw Par Villa

Buddha Tooth Relic Temple

Madame Tussauds Singapore

Lazarus Island

ArtScience Museum

Helix Bridge

Chinatown, Singapore

Little India

River Safari Singapore

East Coast Park

Arab Street Singapore

Mount Faber Park

Orchard Road

Clarke Quay

Siloso Beach

Waterfront Promenade

F1 Street Circuit Driving Experience in Singapore

Raffles Hotel Singapore

Asian Civilisations Museum

Sri Mariamman Temple

Chinese Garden

Changi Chapel and Museum

Fort Canning Park

Adventure Cove Waterpark

Southern Ridges

Changi Beach Park

Singapore Grand Prix

MacRitchie Nature Trail

Bukit Batok Nature Park

Esplanade - Theatres On The Bay

Singapore River

Raffles Landing Site

Boat Quay

VivoCity

Sim Lim Square

Supertree Grove

Fountain of Wealth

Punggol Waterway Park

St John's Island Singapore

Cathedral of the Good Shepherd

Trick Eye Museum Singapore

Geylang Serai Market

Wild Wild Wet

Flower Dome Conservatory

Tiger Brewery Tour

Chinatown Heritage Centre

Butterfly Park & Insect Kingdom

CHIJMES

The Battlebox

MacRitchie Reservoir

Marina Barrage

Sungei Buloh Wetland Reserve

Bukit Timah Nature Reserve

Coney Island

Fort Siloso

Peranakan Museum Singapore

Singapore Armenian Church

Kong Meng San Phor Kark See Monastery

Kusu Island

Bugis Street

Palawan Beach

Tanjong Beach

Tanjong Beach Club

Wave House Sentosa

Lau Pa Sat

Singapore Art Museum

Science Centre Singapore

Civilian War Memorial

Orchidville

Singapore International Festival Of Arts

Sultan Mosque Singapore

Raffles Place

Images Of Singapore LIVE

Suntec City

Wings Of Time

Singapore National Library

MTR

St Andrew's Cathedral

Chek Jawa

Thian Hock Keng Temple

ION Sky

Sri Veeramakaliamman Temple

Singapore City Gallery

Kranji War Memorial

Robertson Quay

Baba House

Lee Kong Chian Natural History Museum

Former Ford Factory

Kwan Im Thong Hood Cho Temple

Ginger Garden

Indian Heritage Centre Singapore

HortPark

Emerald Hill Road

Changi Village

The Istana

Reflections at Bukit Chandu

Parkview Square

Little India Arcade

Gillman Barracks

Sun Yat Sen Nanyang Memorial Hall

Labrador Nature Reserve

Jacob Ballas Children's Garden

Sri Srinivasa Perumal Temple

Chinese Heritage Centre Singapore

German Girl Shrine

Bollywood Veggies

MINT Museum Of Toys

Telok Blangah Hill Park

Red Dot Design Museum

Pasir Ris Park

Cavenagh Bridge

Lian Shan Shuang Lin Monastery

Rainforest Kidzworld

Sri Krishnan Temple

Q SAM

Chek Jawa Visitor Centre

Kent Ridge Park

ReDot Fine Art Gallery

Thow Kwang Pottery Jungle

Abdul Gafoor Mosque

Sri Senpaga Vinayagar Temple

Singapore Musical Box Museum

Jamae Mosque

Kuan Im Tng Temple

Lorong Buangkok

Sakya Muni Buddha Gaya Temple

Sri Vadapathira Kaliamman Temple

Chestnut Park

The Arts House Singapore

First Generation Sculpture

Old Hill Street Police Station

Padang Singapore

Loyang Tua Pek Kong

Sri Thendayuthapani Temple

Sri Sivan Temple

STPI Singapore

Burmese Buddhist Temple Singapore

Capitol Theatre Singapore

Parliament House Singapore

Leong San See Temple

Hajjah Fatimah Mosque

Siang Cho Keong Temple

NUS Museum

Jurong Frog Farm

Ang Mo Kio Town Garden

Hong San See Temple

Hay Dairies Farm

Katong Antique House

Thian Hock Keng Mural

Lim Bo Seng Memorial

NTU Centre For Contemporary Art Singapore

Istana Heritage Gallery

Seng Wong Beo Temple

Cathay Gallery

Masjid Al-Abrar

Gajah Gallery Singapore

Petain Road Singapore

Wei Tuo Fa Gong Temple

Angullia Mosque

Ikkan Art International

Chan+Hori Contemporary

iFly

Henderson Waves

Hawker Centres

Maxwell Food Centre

Chinese New Year in Singapore

Zoukout

Geylang

Church Of The Holy Family Singapore

Bukit Brown Cemetery

Singapore Philatelic Museum

Singapore Visitor Centre

Swan Lake

Jalan Besar

The Intan

Tiong Bahru

Yueh Hai Ching Temple

Nanyang Academy Of Fine Arts

Sundaram Tagore Gallery Singapore

Cycling at Pulau Ubin

People's Park Complex

Malay Heritage Center

Splash N Surf

DUCKtours Singapore

Port Of Lost Wonder

Jurong East Malls

Amitabha Buddhist Centre

Mizuma Gallery

Cape of Good Hope Art Gallery

Partners & Mucciaccia

Green Corridor

Punggol Beach

Pu Ji Si Buddhist Research Centre

Sri Muneeswaran Hindu Temple

Land, Sea & Sky City Pass

Art-2 Gallery

Jurong Hill Lookout Tower

Jejawi Tower

Istana Change Of Guards

Large Reclining Figure

Thaipusam

Abundance III Sculpture

Club Street Singapore

Six Brushstrokes

Deepavali

Dairy Farm Nature Park

Tekka Centre

Theemithi in Singapore

Singapore International Film Festival

Marine Cove Playground

Kranji Farms

Changi Village Hawker Centre

Keppel Hill Reservoir

Everton Park

Myra's Beach Club

Beaches On Sentosa

Hungry Ghost Festival

Mountain Biking Parks

Mid-Autumn Festival in Singapore

Westgate Wonderland

Former Saint Joseph's Institution

Mount Serapong

Masjid Malabar

Botanic Garden Tanglin Gate

Chingay Parade Singapore

Mosaic Music Festival

Singapore International Jazz Festival

Singapore Food Festival

Vesak Day

Great Singapore Sale

Haji Lane

Ann Siang Hill

Beerfest Asia

Affordable Art Fair

Laneway Festival Singapore

Per Person

57,990

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

51,999

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

27,500

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 109 Reviews )

( 109 Reviews )

Per Person

42,999

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 288 Reviews )

( 288 Reviews )

Per Person

50,880

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

19,500

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Total

4,81,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 20 Reviews )

( 20 Reviews )

Per Person

18,511

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 19 Reviews )

( 19 Reviews )

Per Person

34,999

*EXCLUDING APPLICABLE TAXES 3.4 Ratings

( 19 Reviews )

( 19 Reviews )

Per Person

17,680

*EXCLUDING APPLICABLE TAXES Indonesia - Travel Insurance

View Gallery - 28

View Gallery - 28 Travel insurance is not a strict requirement for visiting Indonesia, but it is highly recommended. Comprehensive coverage for medical emergencies, trip cancellations, lost luggage, and unexpected delays can be invaluable. Indonesia's adventurous activities and diverse environments may carry inherent risks, making insurance a sensible choice to ensure a secure and worry-free journey throughout the beautiful archipelago.

Per Person

47,750

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

35,439

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 288 Reviews )

( 288 Reviews )

Per Person

59,759

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

65,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 57 Reviews )

( 57 Reviews )

Per Person

17,999

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 9 Reviews )

( 9 Reviews )

Per Person

42,499

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 109 Reviews )

( 109 Reviews )

Per Person

48,000

*EXCLUDING APPLICABLE TAXES 4.2 Ratings

( 38 Reviews )

( 38 Reviews )

Per Person

40,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 239 Reviews )

( 239 Reviews )

Per Person

29,500

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 9 Reviews )

( 9 Reviews )

Per Person

61,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Malaysia - Travel Insurance

View Gallery - 28

View Gallery - 28 Travel insurance is not a strict requirement for visiting Malaysia, but it is highly advisable. A comprehensive policy covering medical emergencies, trip cancellations, lost luggage, and unexpected delays can provide essential protection. Malaysia offers a mix of cultural experiences and outdoor activities, so having insurance is a wise choice to ensure a safe and stress-free trip.

Places to visit in Malaysia

Kuala Lumpur

Langkawi

Georgetown Penang

Genting Highlands

Cameron Highlands

Kota Kinabalu

Ipoh

Pekan

Petaling Jaya

Batu Caves

Melaka

Batu Ferringhi

Tioman Island

Kuantan

Putrajaya

Kuching

Perlis

Port Dickson

Klang

Shah Alam

Kuala Selangor

Subang Jaya

Taiping

Pangkor Island

Kuala Kangsar

Teluk Bahang

Johor Bahru

Muar

Kota Tinggi

Mersing

Batu Pahat

Raub

Bentong

Kuala Terengganu

Redang Island

Perhentian Islands

Bau

Sibu

Bintulu

Miri

Seremban

Kuala Pilah

Alor Setar

Labuan

Sandakan

Tawau

Semporna

Sepilok

Per Person

29,500

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 21 Reviews )

( 21 Reviews )

Per Person

34,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

18,280

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 9 Reviews )

( 9 Reviews )

Per Person

48,000

*EXCLUDING APPLICABLE TAXES 4.2 Ratings

( 38 Reviews )

( 38 Reviews )

Per Person

24,900

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

28,780

*EXCLUDING APPLICABLE TAXES Per Person

19,780

*EXCLUDING APPLICABLE TAXES Per Person

19,450

*EXCLUDING APPLICABLE TAXES Per Person

24,700

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

22,900

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

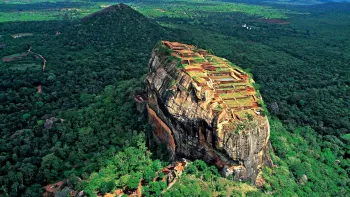

Sri Lanka - Travel insurance

View Gallery - 28

View Gallery - 28 Travel insurance is not mandatory for visiting Sri Lanka, but it is strongly recommended. A comprehensive policy that includes coverage for medical emergencies, trip cancellations, lost luggage, and unexpected delays is advisable.

Sri Lanka's diverse landscapes and cultural experiences can carry inherent risks, making insurance a valuable safety net. Having the right coverage ensures a worry-free and secure journey through this beautiful island nation.

Places to visit in Sri Lanka

Per Person

49,500

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 4 Reviews )

( 4 Reviews )

Per Person

23,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 157 Reviews )

( 157 Reviews )

Per Person

21,690

*EXCLUDING APPLICABLE TAXES 4.3 Ratings

( 218 Reviews )

( 218 Reviews )

Per Person

23,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 157 Reviews )

( 157 Reviews )

Per Person

16,450

*EXCLUDING APPLICABLE TAXES Per Person

17,530

*EXCLUDING APPLICABLE TAXES Per Person

19,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 157 Reviews )

( 157 Reviews )

Per Person

336

*EXCLUDING APPLICABLE TAXES Per Person

31,500

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Per Person

31,499

*EXCLUDING APPLICABLE TAXES 4.9 Ratings

( 185 Reviews )

( 185 Reviews )

Maldives - Travel Insurance

View Gallery - 28

View Gallery - 28 Travel insurance is not a strict requirement for visiting the Maldives, but it is highly advisable. A comprehensive policy that covers medical emergencies, trip cancellations, lost luggage, and unexpected disruptions is recommended. The Maldives' idyllic islands and water activities can involve certain risks, making insurance a smart choice to ensure a secure and enjoyable trip. While not mandatory, it provides peace of mind during your visit to this stunning destination.

Places to visit in Maldives

Per Person

70,000

*EXCLUDING APPLICABLE TAXES 4.3 Ratings

( 218 Reviews )

( 218 Reviews )

Per Person

1,13,456

*EXCLUDING APPLICABLE TAXES Per Person

1,08,999

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

1,24,500

*EXCLUDING APPLICABLE TAXES 4.8 Ratings

( 95 Reviews )

( 95 Reviews )

Per Person

43,799

*EXCLUDING APPLICABLE TAXES 3.4 Ratings

( 19 Reviews )

( 19 Reviews )

Per Person

75,999

*EXCLUDING APPLICABLE TAXES 4.6 Ratings

( 22 Reviews )

( 22 Reviews )

Per Person

68,000

*EXCLUDING APPLICABLE TAXES 4.2 Ratings

( 38 Reviews )

( 38 Reviews )

Per Person

39,000

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 4 Reviews )

( 4 Reviews )

Per Person

71,000

*EXCLUDING APPLICABLE TAXES 3.4 Ratings

( 19 Reviews )

( 19 Reviews )

Per Person

98,500

*EXCLUDING APPLICABLE TAXES 5.0 Ratings

( 255 Reviews )

( 255 Reviews )

Why are more countries making travel insurance a must?

View Gallery - 28

View Gallery - 28 Countries are increasingly making travel insurance a must for several reasons. Firstly, it helps ensure that travelers have financial protection in case of unexpected events, such as medical emergencies or trip cancellations, which can be costly.

This minimizes the potential burden on a country's healthcare system and resources. Additionally, it can alleviate the strain on local services when travelers face unforeseen circumstances.

Travel insurance also provides a safety net for tourists, enhancing their overall travel experience and reducing the likelihood of encountering difficulties that could strain diplomatic relations or tourism industries.

Debalina Deb Roy

A seasoned travel writer with a passion for exploring off beat destinations and uncovering the hidden gems. My ultimate goal is to inspire people to step out of their comfort zones and explore the world.

Explore best popularTour Packages

Tripclap connects you with top travel agents

Compare Custom Quotes and get the best package deal

1

Trusted Network Of 8000+ Agents.

2

Book everything together, including stay & transport.

3

Compare agent profiles & verified reviews.

How It Works

Compare Custom Quotes from Top Travel Agents.

Tell us about your trip

Get Custom quotes from top agents.

Choose the package you like

Latest Destinations : -

• Sangla • Ubon Ratchathani • Hampi • Kon Tum • Kumaon • Vattakanal • Koh Si Chang • Vythiri • Yinchuan • Koh Samui • Port Dickson • Long Xuyen • Mount Abu • Bangkok • Son La • Thattekad Bird Sanctuary • Pahalgam • Yusmarg • Diu • Canary Islands • Dras • Bruges • Kamshet • Petaling Jaya • Naples • Naftalan • Zurich • Barpeta • Kufri • Krabi Town • Mirik • Varanasi • Kundapur • Taipei • Mui Ne • Shimoga (Shivamogga) • Dapoli • Lausanne • Pai • Ziro • Saputara • Kutrallam • Chamba • Naggar • Oxford • Dibrugarh • Gurgaon • Muar • Warsaw • Koh Lanta

• Sangla • Ubon Ratchathani • Hampi • Kon Tum • Kumaon • Vattakanal • Koh Si Chang • Vythiri • Yinchuan • Koh Samui • Port Dickson • Long Xuyen • Mount Abu • Bangkok • Son La • Thattekad Bird Sanctuary • Pahalgam • Yusmarg • Diu • Canary Islands • Dras • Bruges • Kamshet • Petaling Jaya • Naples • Naftalan • Zurich • Barpeta • Kufri • Krabi Town • Mirik • Varanasi • Kundapur • Taipei • Mui Ne • Shimoga (Shivamogga) • Dapoli • Lausanne • Pai • Ziro • Saputara • Kutrallam • Chamba • Naggar • Oxford • Dibrugarh • Gurgaon • Muar • Warsaw • Koh Lanta

Best Selling Domestic Tour Packages : -

Kashmir Tour Packages Andaman Tour Packages Kerala Tour Packages Shimla Tour Packages Manali Tour Packages Sikkim Tour Packages Uttarakhand Tour Packages Rajasthan Tour Packages Chardham Tour Packages Gujarat Tour Packages Rameswaram Tour Packages Gangtok Tour Packages Goa Tour Packages Jaipur Tour Packages Ooty Tour Packages Jim Corbett Tour Packages Mussoorie Tour Packages Kanyakumari Tour Packages Meghalaya Tour Packages Ladakh Tour Packages

Kashmir Tour Packages Andaman Tour Packages Kerala Tour Packages Shimla Tour Packages Manali Tour Packages Sikkim Tour Packages Uttarakhand Tour Packages Rajasthan Tour Packages Chardham Tour Packages Gujarat Tour Packages Rameswaram Tour Packages Gangtok Tour Packages Goa Tour Packages Jaipur Tour Packages Ooty Tour Packages Jim Corbett Tour Packages Mussoorie Tour Packages Kanyakumari Tour Packages Meghalaya Tour Packages Ladakh Tour Packages

Best Selling International Tour Packages : -

Dubai Tour Packages Bali Tour Packages Singapore Tour Packages Thailand Tour Packages Maldives Tour Packages Bhutan Tour Packages Vietnam Tour Packages Mauritius Tour Packages Nepal Tour Packages Europe Tour Packages Sri lanka Tour Packages Turkey Tour Packages Malaysia Tour Packages Azerbaijan Tour Packages

Dubai Tour Packages Bali Tour Packages Singapore Tour Packages Thailand Tour Packages Maldives Tour Packages Bhutan Tour Packages Vietnam Tour Packages Mauritius Tour Packages Nepal Tour Packages Europe Tour Packages Sri lanka Tour Packages Turkey Tour Packages Malaysia Tour Packages Azerbaijan Tour Packages

Certified

We accept (more)

Members of

Media Recognition

Trusted Partners

Award

Copyrights © TripClap. All Rights Reserved

May

May June

June July

July August

August September

September October

October November

November December

December January

January February

February March

March April

April